Life Settlement Guide

What Is a Life Settlement?

In a life settlement, you sell your life insurance policy in exchange for a cash payment.

The buyer pays you a lump sum for your policy.

Buyers of life settlements are called providers. They take over the premiums and receive the death benefit when you pass away.

How Does a Life Settlement Work?

A life settlement broker screens your policy to see if you qualify. Should your policy qualify, the broker will start the process of building a file to take your policy to the providers for an auction.

Next, the broker will obtain a signed release from the insured to gather their medical records needed to proceed and the broker will gather information on the performance of your existing policy.

Each buyer then calculates the value of your policy. The factors that determine the lump sum they pay include:

- The amount of the death benefit

- Your medical condition(s)

- The cost of premiums

- Any loans or advances taken against the policy, if applicable

- The rating of the issuing insurance company

- Current interest rates

You may receive multiple offers. You decide which one to accept. If none are suitable, you can refuse all of them.

Should you choose an offer, you then transfer the policy to that buyer. The buyer becomes the policy’s beneficiary upon transfer.

In return, the buyer puts your lump sum into an escrow account. You receive the money once the transfer of ownership is complete.

Based on lisa.org "Most life settlement transactions take, on average, from four to five months to complete."

How Do You Qualify for a Life Settlement?

In order to qualify for a life settlement, certain criteria must be met. Typically, to sell your policy you must:

- Be at least 70 or older or

- Have a life expectancy of less than 20 years or be chronically ill

- Own a term or permanent life insurance policy

- Have a policy with a death benefit of at least $250,000

However, criteria can vary. For example, a few life settlement companies accept policies with death benefits as low as $50,000. To know if your policy qualifies, contact Evolved Life Settlements directly.

Why Do People Sell Their Life Insurance Policy?

There are many reasons why people sell their policies (Investopedia). You might consider selling your policy if you:

- Cannot afford the premiums

- Need to cover other expenses

- No longer need the policy

- Hold a term policy that’s about to expire

- Have a term policy conversion privilege about to expire

- Want to supplement your retirement income

- Need to pay for long-term care

- Have a buy-sell or key person policy no longer needed

- No longer have an estate tax liability

- Bought a policy for a business you no longer own or run

You may have more than one reason for selling your policy. For example, you may no longer need the policy. At the same time, you may need funds to pay for long-term care.

Ready to learn how much your life insurance policy may be worth?

GET AN ESTIMATE TODAY!

What are the Advantages and Disadvantages of a Life Settlement?

Advantages

Cash for Expenses

You Stop Paying Premiums

A life settlement can help if you are struggling to pay your premiums. Along with receiving a lump sum, you can stop paying your premiums once the sale is complete.

This can make sense if you no longer need your policy. You save money from not paying premiums. You can use the amount you save to fund other needs in your life.

Disadvantages

Your Proceeds May Be Taxed

You Can Be Disqualified for Some Types of Government Support

The proceeds from a life settlement can place you in a higher income bracket. This can mean that you may become ineligible for:

- Medicaid

- SSI

- SNAP food benefits

- Section 8 or HUD housing benefits

Each policy owner should consult their own tax advisor for the impacts of receiving proceeds from a life settlement.

What Are the Different Types of Life Settlements?

Traditional

Viatical

Viatical settlements are similar to traditional life settlements. The difference is that they are for those whose life expectancy is less than twenty-five months.

Viatical settlements typically pay more than traditional life settlements as a result of the shortened premium period the buyer expects to pay the premium and the expected collection of the death benefit within twenty-five months. Therefore, they are willing to pay more.

If you have a terminal illness, you may qualify for a viatical settlement.

You may also qualify if your life expectancy is greater than twenty-five months.

Retained Death Benefit

A retained death benefit (RDP) is when you sell a portion of your policy. You receive a smaller lump sum than if you were to sell the entire policy.

The buyer then becomes responsible for paying part or all of your premiums.

A portion of your policy’s death benefit goes to the buyer. The remainder passes to your beneficiaries.

What Is the Life Settlement Transaction Process?

1) Estimate Policy Value

A life settlement broker can help you with the process of selling your policy. To begin, they need to estimate the value of your policy. To do this they start by asking you some initial questions.

The four main factors they consider are your age, the type of policy, the current premium, and the amount of the death benefit. They also ask how long you’ve owned the policy.

Ideal candidates are aged 70 or older. Your policy may qualify if you are younger than 70 or have a serious illness.

Most buyers only consider policies with a death benefit of at least$250,000, but some will look at policies below $250,000. Life settlement providers need higher profits to cover their expenses.

Your policy can be a permanent life insurance policy or a term life insurance policy. This policy can be an individual or group policy.

Finally, the buyer needs to know how long you’ve had the policy. States require that a policy be held for a certain number of years before selling. Each state has its own requirements.

2) Complete an Application & Obtain Medical Records

Next, you fill out a life settlement application. The application contains basic questions regarding you and your policy.

You also need to fill out a medical release form. The buyer needs your medical history for the past five years. The underwriter uses this information to calculate your expected lifespan. A shorter lifespan increases the amount a buyer will pay.

Finally, you complete an authorization form. This form goes to your broker. This allows them to confirm the details of your policy directly with your insurance company.

3) Submit to Auction

A life settlement broker presents your policy to multiple buyers. We call this an auction market.

This creates competition among buyers and helps you receive a higher price.

4) Review Bids

Your broker will then present the bids for you to review.

You usually have up to 14 days to review and accept a bid.

5) Decide to Keep or Sell

At this point, you may accept or decline any offer.

It is important at this point to determine if you would rather keep the policy or sell to a provider. We recommend reviewing your options with your trusted advisor.

Should you accept an offer, the broker informs the provider, and you will move forward with completing the closing package and underwriting review.

6) Complete Closing Package & Underwriting Review

The buyer will conduct a formal underwriting review based on the information provided.

The buyer then sends a closing package to your life settlement broker. The documents included in the package depend on the state in which you live.

The package often includes three items:

- a contract

- verification from the insurer that the policy is still active

- a letter stating you are of sound mind.

You also have to sign documents changing ownership and the beneficiary to the buyer.

7) Close & Recieve Cash Payout

Once the buyer receives your closing package, they transfer your lump sum to an escrow account. An escrow agent verifies the documents you signed.

The buyer completes the transfer of ownership. The funds in the escrow account are then released to you.

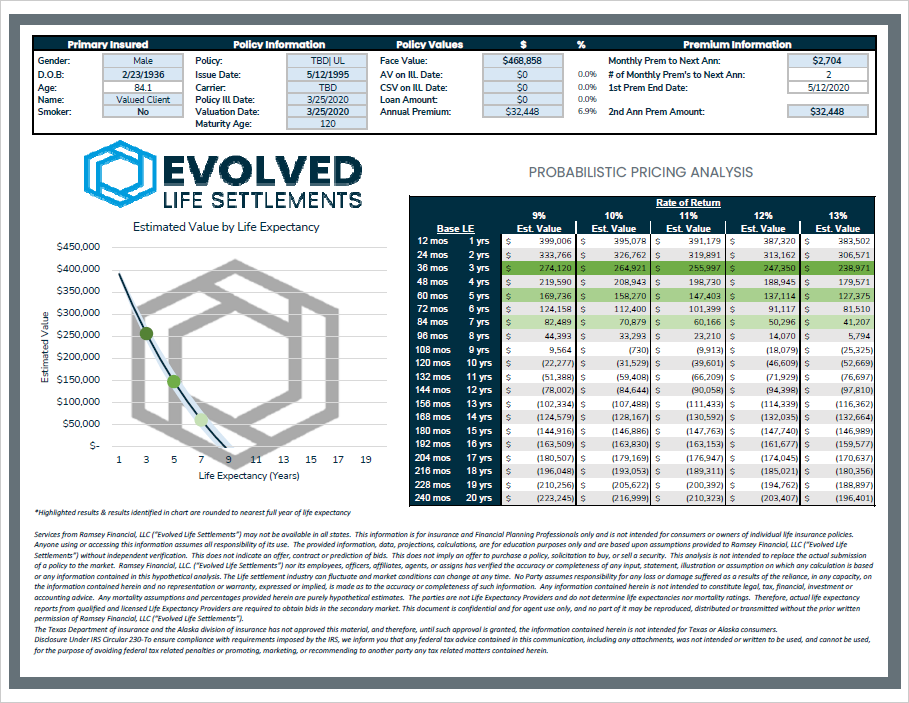

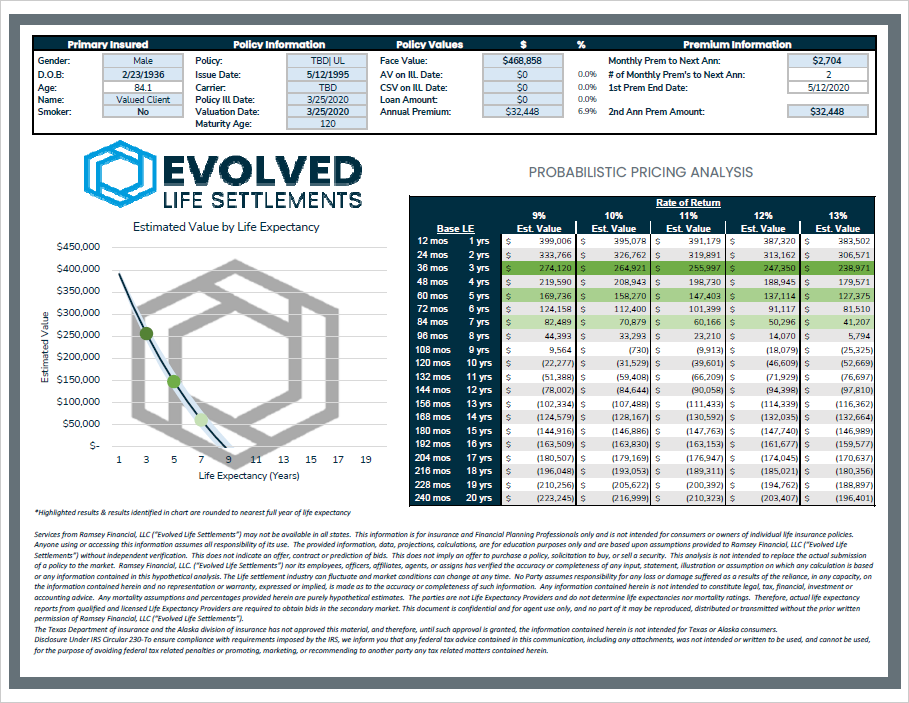

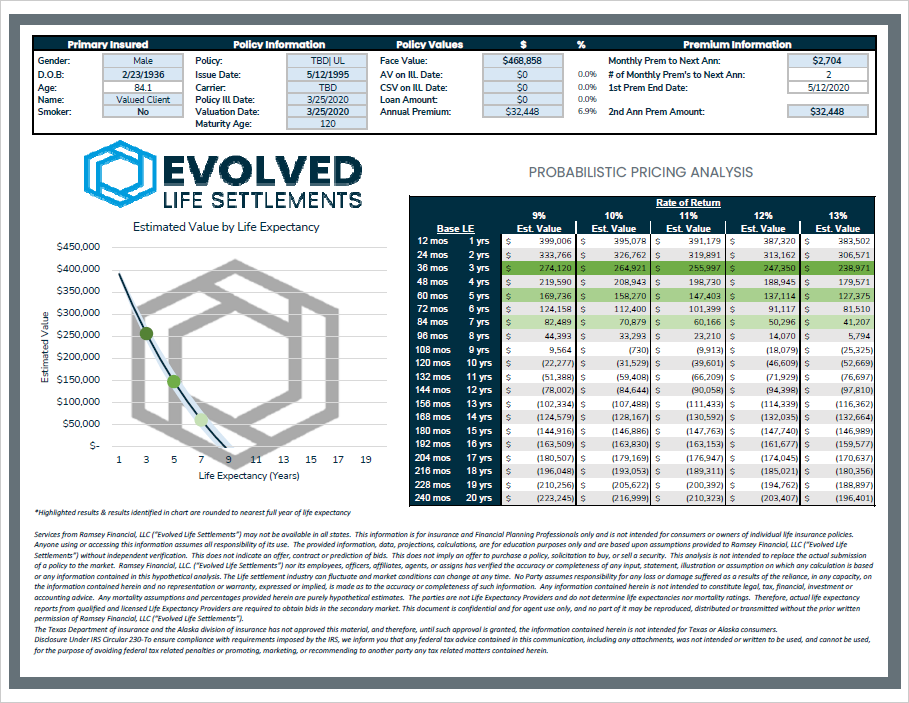

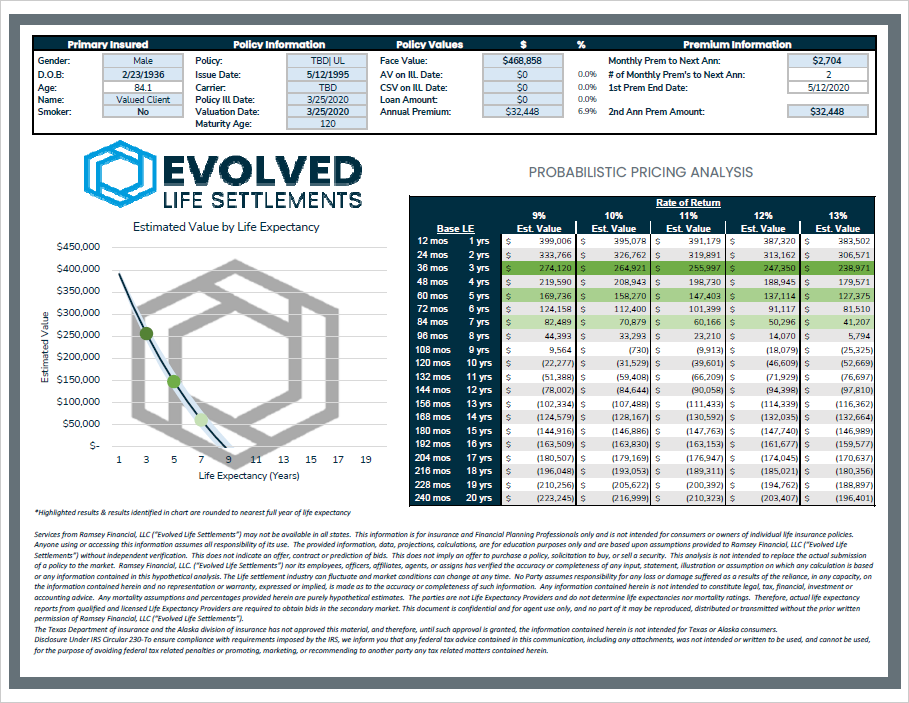

How Is the Value of Your Life Insurance Policy Determined?

Buyers consider three main factors: life expectancy, the cost of keeping the policy in force, and the amount of the death benefit.

These factors determine the amount providers will offer on a policy.

Life Expectancy

The buyer reviews the life expectancy reports that are based on the insureds overall health as determined by current and past medical records.

The life expectancy reports will take into consideration your lifestyle habits, tobacco usage, alcohol use, and other medical factors.

The shorter your life expectancy, the higher the bid for your policy. The buyer assumes they can receive the death benefit from your policy sooner.

Likewise, you receive less when you are expected to live longer.

The Cost of Keeping the Policy In-Force

Since the buyer takes over the premiums, your policy’s annual cost is a factor.

Typically more efficient policies will yield a better settlement value.

The Death Benefit of the Policy

Perhaps the biggest factor is the amount of your policy’s death benefit.

Most buyers only consider policies with a death benefit of at least $250,000, but some will look at policies below $250,000.

Other factors beyond these three may affect the amount you receive. These include current market conditions and your policy’s cash value.

Other Factors

Ready to learn how much your life insurance policy may be worth?

GET AN ESTIMATE TODAY!

Do I Owe Taxes If I Sell My Life Insurance Policy?

A life settlement can incur taxes. Therefore, taxes should be a factor when considering a life settlement.

Tax laws change, therefore we advise you to consult with your tax advisor before moving forward with a life settlement.

How a Life Settlement Is Taxed

How Are Life Settlements Regulated?

As of June 2021, 42 U.S. States regulate life settlements. These regulations are overseen by the state’s Department of Insurance.

Rules may include when you would receive your money or how the transfer of ownership takes place. Your state may also regulate how much commission your broker can receive.

If you reside in a state that regulates life settlements, a broker or buyer must follow these rules.

These rules are meant to protect you, the seller, as well as the buyer.

Policy Ownership Anniversary

As of June 2021, some states require you keep a policy for a minimum number of years. This prevents you from taking out a policy for the sole purpose of selling it.

If you live in one of the following states, you have to wait at least five years before you can sell your policy:

- OR

- NV

- ND

- NE

- IO

- WI

- OH

- WV

- NH

- FL

If you live in Minnesota, you have to wait at least four years.

These states do not regulate life settlements. Thus, no waiting period exists other than the two-year contestability period and suicide provisions.

- AL

- MI

- MO

- NM

- SC

- SD

- WY

- Washington D.C.

All other states require that you wait at least two years before selling.

You still may be able to sell your policy during the mandatory waiting period, if your state has one. Some of these states allow exemptions. Such events include recently retired or divorced or the death of a spouse. Other major life events may apply.

You can check with your state’s Department of Insurance to find out its rules for life settlements. You can also consult with a financial advisor or life insurance broker licensed in your state.

Your Disclosures and Transparency

Most states have laws that require brokers and buyers to disclose important information to you. In other words, they must be truthful in the facts regarding your policy.

Your state may require your broker to inform you of:- all offers, counter-offers, acceptances and rejections from buyers

- your lump sum being subject to creditors’ claims

- the rescission period, which is the number of days to change your mind after the sale

- the amount of their commission from the sale

- other options besides selling your policy

Broker Licensing

All life settlement brokers must hold a license in life insurance. They must also have an additional life settlement license. The license in life settlements usually requires the broker to have additional training and experience.

Fiduciary Duty

Depending on your state, your broker may also have a fiduciary duty to represent you. A fiduciary duty means they are legally required to work in your best interests, not the buyers.

This is an important consideration. We advise you to work with an individual who acts as a fiduciary.

Be sure to check with your state’s Department of Insurance to verify that your broker is properly licensed. You can also check with your state regarding your broker’s fiduciary duty.

Life Insurance Settlement Association (LISA)

The Life Insurance Settlement Association (LISA) is a non-profit organization. It consists of brokers, buyers, financing entities, and other service providers related to life and viatical settlements.

LISA educates consumers and advisors about life settlements.

What Should You Consider Before Doing a Life Settlement?

Life Settlement Fees

Your broker earns a commission for helping to sell your policy. Their fee is a percentage of one of the two most common values:

- Percentage of the face value of the policy. The face value is the original death benefit. It does not include any outstanding loans against the policy.

- Percentage of the sale price of the policy. Since the sale price is a much smaller amount than the face value, a higher percentage is used.

The percentage of broker fees ranges from 6%-10% of the policy’s face value or 30% of the offer.

How to Calculate a Life Settlement Fee

For example, if your policy’s face amount is $500,000 and you receive an offer for $120,000, the fees could be calculated like this:

$500,000 X 8% of the policy’s face value = $40,000

OR

$120,000 X 30% of the offer = $36,000

A broker usually charges the lesser of these two fees.

They would charge $36,000 for the sale of this policy, not $40,000.

Taxes When You Sell Your Policy

As explained above, you may owe taxes.

The proceeds of a life settlement are almost certainly taxable. The assistance of a professional tax advisor should always be sought. The proceeds of a life settlement could also be subject to the claims of creditors. If the seller is within two years of death, other laws making the proceeds tax-free may apply.

Leaving Beneficiaries With Nothing

A life settlement transfers ownership of your policy to another person or institution. This means your current beneficiaries lose the death benefit.

You should determine if there is a need to keep the life insurance policy to leave to your beneficiaries.

We recommend talking to the beneficiaries about the transaction. Including asking family members if they would like to assume the premium payments in future years on the policy.

What Are Alternatives to Life Settlements?

Accelerated Death Benefit

One alternative to a life settlement is utilizing the accelerated death benefit (ADB) should your policy have one.

An accelerated death benefit allows you to take money from your policy, tax-free. It is deducted from the death benefit.

You do not need to pay back the money you withdraw. However, if you do not pay it back, your beneficiaries receive less upon your death. The amount they would receive would be the original death benefit minus the amount of the withdrawal.

There are tight restrictions on when you can use an ADB. In some cases, it can only be exercised if you are terminally ill and have a life expectancy of less than two years.

You may also be able to use the ADB if you are dealing with a chronic or serious illness.

Finally, you might be able to withdraw money from your death benefit if you have difficulty with everyday activities. The everyday activities included are eating, bathing, dressing, mobility, maintaining continence and toileting.

The situations that apply are stated in your policy. Your insurance company or broker can help determine if you qualify.

Should you wish to use your ADB, you still need to pay your premiums to keep the policy in force.

Policy Loan

If you need cash, you could consider a loan against your policy. This is known as a death benefit or life insurance loan.

The interest on the loan varies by policy. You can choose when to pay it back. You also have the option of not paying it back at all.

Should you not pay it back, the loan amount plus interest is deducted from the death benefit. As a result, your beneficiaries receive less.

Surrender the Policy

You might choose to surrender your policy instead of choosing a life settlement.

Surrendering your policy may be an option if:- it’s no longer needed

- you can’t afford the premiums

- you want to access its cash value

- you’ve found a better policy

When you surrender your policy, you lose the death benefit.

You may be charged a surrender fee. Surrender fees vary and the older your policy, the less you pay. Policies ten years or older may not incur any fees.

In exchange, you are given the policy’s cash surrender value. The cash surrender value is the equity in the policy plus interest or dividends minus any fees and loans.

Who Is Involved in a Life Settlement?

Policy Owner

The policy owner is the person who bought the policy. The policy owner may also be the insured but not always.

Insured

The insured is the person whose death triggers the death benefit. When the insured dies, the beneficiaries receive money from the policy.

Life Settlement Brokers

Life settlement brokers facilitate the sale of a life insurance policy. They act on behalf of the policy owner. They are responsible for presenting policies to buyers for purchase.

Life Settlement Providers

Life settlement providers are the buyers of life insurance policies for sale.

Insurance Company

The insurance company issued the policy.

Insurance companies accept premium payments in exchange for taking on risk.

Life insurance companies must legally pay the death benefit on an in-force policy when the insured passes away. This death benefit goes to the beneficiaries listed in the policy.

Ready to learn how much your life insurance policy may be worth?

GET AN ESTIMATE TODAY!

Life Settlement FAQs

Ready to learn how much your life insurance policy may be worth?

GET AN ESTIMATE TODAY!

EVOLVED LIFE SETTLEMENTS

Helping you get the most value out of your life insurance policy.Our goal is to maximize your policy value and obtain the highest bids available in the life settlement market. We do this by using our underwriting and product expertise to help you reach a higher policy valuation. This process allows us to help you negotiate the best options for you and your family.

We take a client-first approach and make sure we are doing what we can to maximize the value of your offers.

Contact:

Contact the Evolved Life Settlements team to reach one of our trained staff members. We’ll help review any unanswered questions or help you begin the life settlement process.

If you would like to make an appointment, you can call our office directly at (501) 404-0000 or email our team at team@evolvedsettlements.com

Little Rock, AR 72212